Tax Initiative

Comparing Actual Taxes

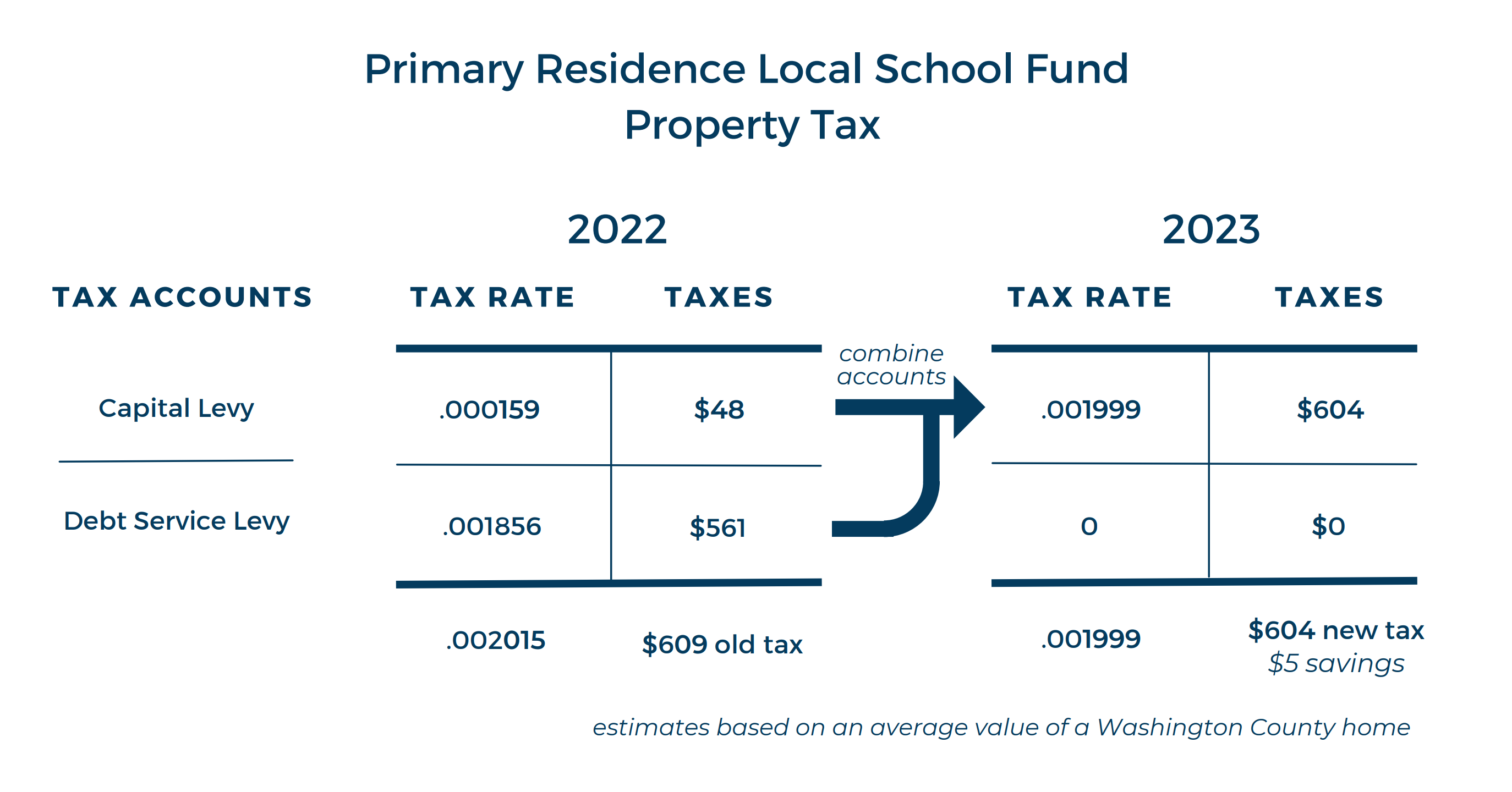

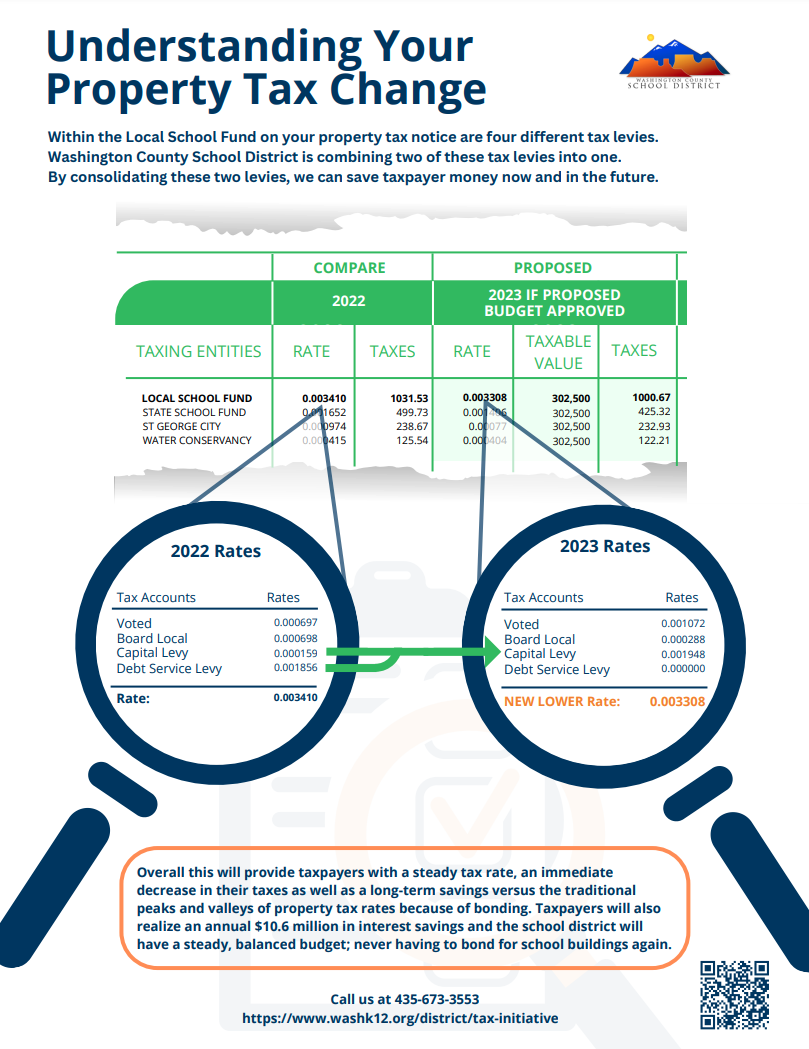

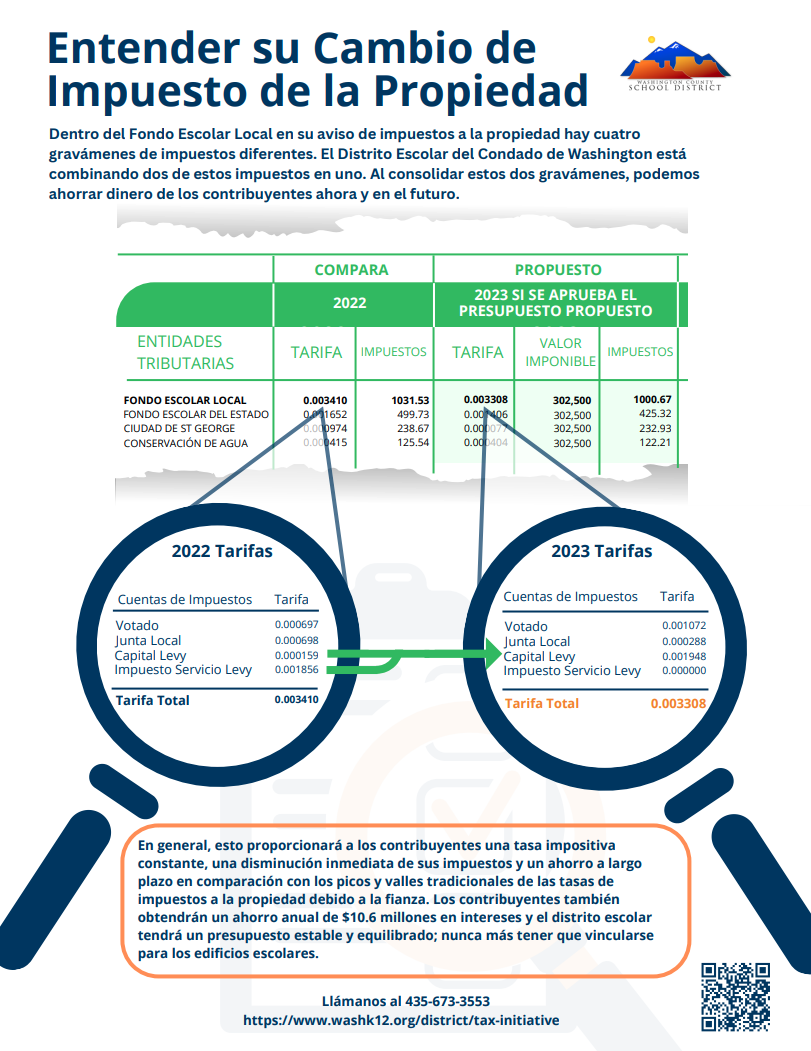

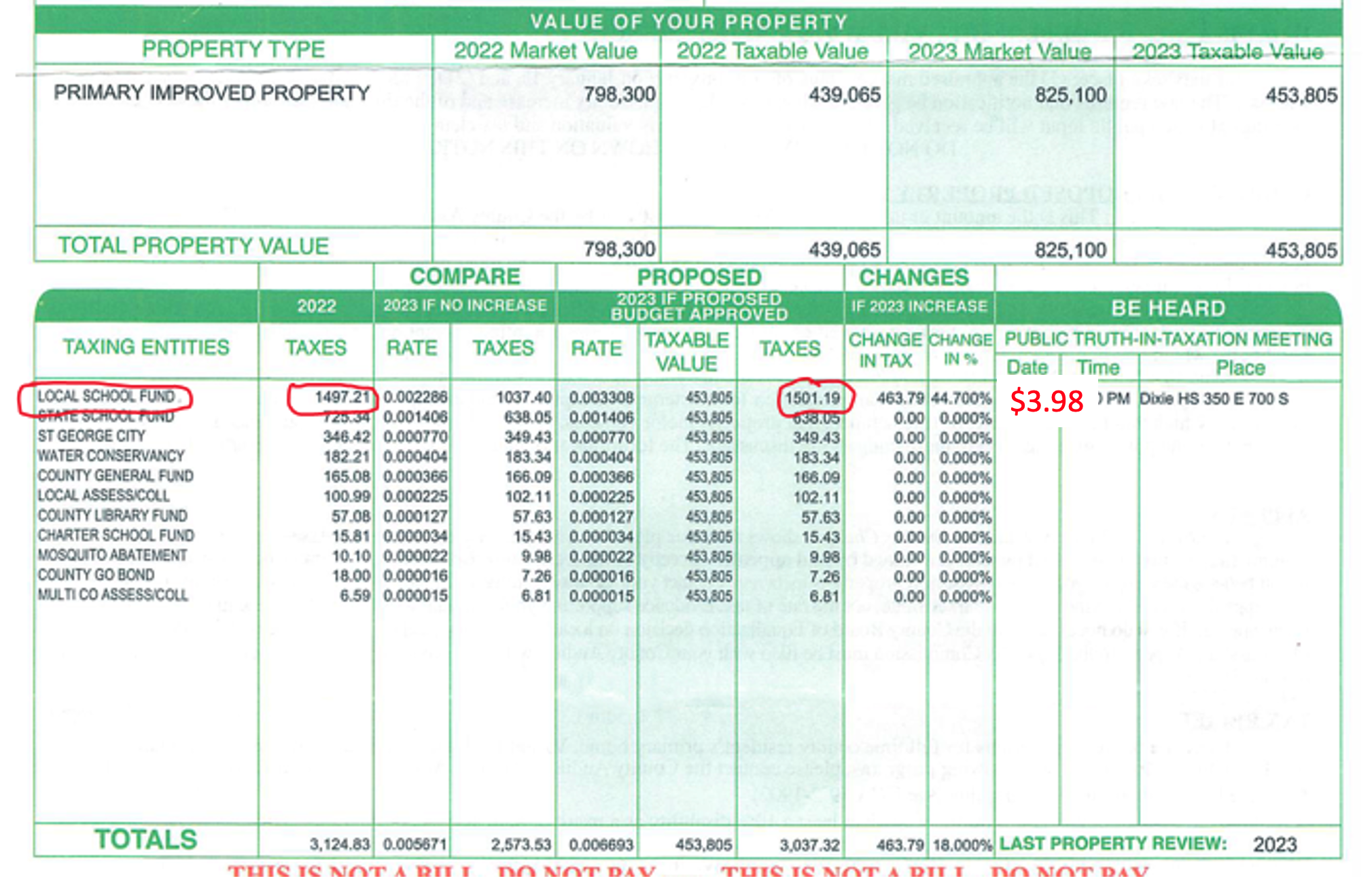

Take a moment to compare on your county property tax notice what you paid in property taxes in 2022 to what you will pay in 2023 if the budget is approved. In many cases you will find that the actual property taxes you might pay will be slightly less than what you paid in 2022. In this example, the taxes will be slightly more (about $4 more).

PLEASE VIEW THE EXAMPLE BELOW:

TRUTH IN TAXATION MEETING AT DIXIE HIGH SCHOOL – MONDAY AUGUST 7, 2023 @ 6:00PM

Download the PDF Version of the Understanding Your Property Tax Change >

Becoming Debt Free in 2023

Becoming Debt Free in 2023

With only 6 debt-free school districts in Utah, Washington County is poised to become the seventh debt-free school district in the state.

We’ve spent the past five years preparing to become self sufficient, living within our budget, and not asking taxpayers to approve future bonds for new construction.

In doing so, we will also save taxpayers more than $10 million dollars each year in interest payments, we will not have any interest bearing loans and we will live completely within our annual budget.

This will be a tremendous benefit for our taxpayers and our community.

THE PLAN:

- Shift taxes from one account to another

- Taxpayers realize a slight decrease in taxes

- The District becomes debt free and more self sufficient

- Taxpayers save $10.6 million dollars every year in interest payments

- The District pays cash for all new construction, saving taxpayers millions

- The District never asks taxpayers to fund a bond for new construction again!

Please SUPPORT THE NEW TAX INITIATIVE!

The Plan Outline